The East Med Energy Report is published by Middle East Strategic Perspectives in collaboration with Obeid & Medawar Law Firm.

Lebanon and Israel reach deal on maritime border

Lebanese and Israeli officials announced in the morning of October 11 that they accepted the final version of the maritime border deal delivered hours earlier by the US mediator Amos Hochstein.

Key to the success was the crafting of a deal that allows both sides to claim victory and to sell the agreement to their citizens amid a sensitive political period in Lebanon and in Israel. Officials in both countries are racing against time:

In Lebanon, where the Prime Minister-designate has been unable to form a government, President Michel Aoun’s term expires on October 31, with little indication that the Parliament will be able to elect a successor in time. In Israel, caretaker PM Yair Lapid is in a precarious position in the run up to the legislative elections on November 1, Israel’s fifth in four years.

The perception of a win-win outcome was reflected in the declarations by both countries’ lead negotiators on the day the final version of the US draft was submitted: Lebanon’s Deputy Speaker Elias Bou Saab said that the text “takes into consideration all of Lebanon’s requirements”. Similarly, Israeli National Security Advisor Eyal Hulata announced that “all of Israel’s demands have been met”.

The new maritime boundary

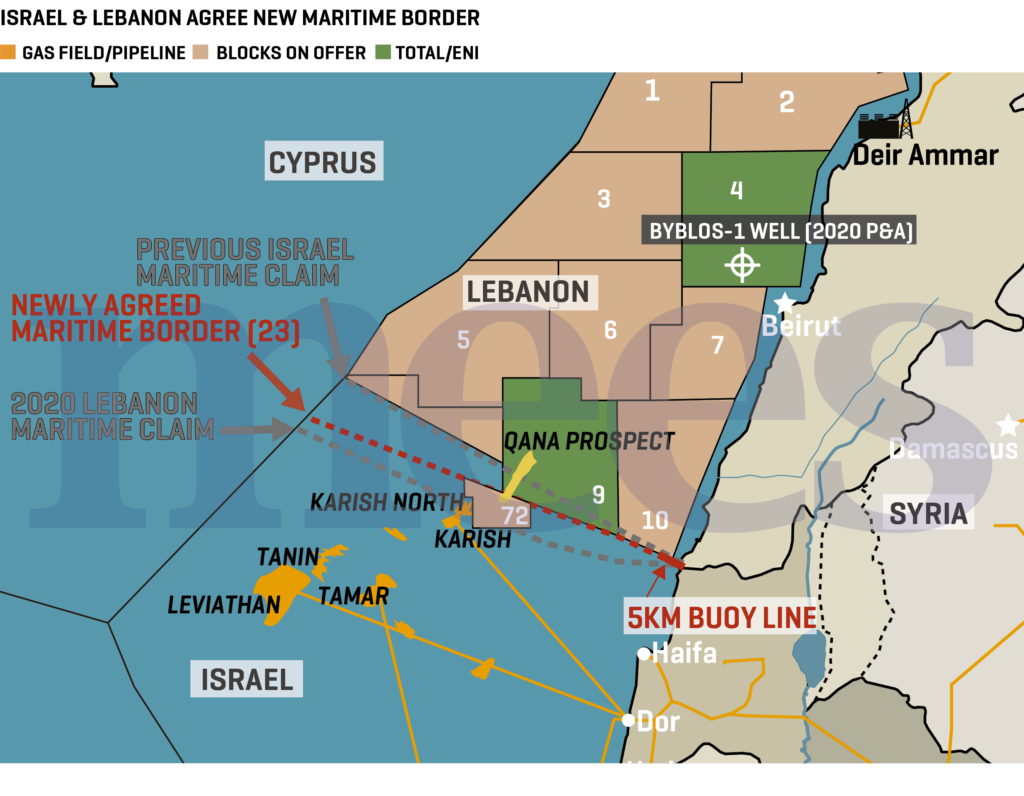

The newly agreed maritime boundary largely corresponds to Line 23, the line officially regarded by Beirut as the southern limit of its Exclusive Economic Zone (EEZ).

However, the first five kilometers from the coastline will follow the current line of buoys unilaterally placed by Israel following its withdrawal from Lebanon in 2000. The area south of the line is regularly patrolled by the Israeli navy to ensure the security of the northern Israeli coast. Israel sought a recognition of the line of buoys in the agreement. Lebanon refused to acknowledge it as a boundary but ultimately agreed to preserve the status-quo in that area until both parties decide to delimitate their land boundary.

As a result of the deal, Lebanon drops any claim for a larger EEZ extending until Line 29 put forward with the start of indirect negotiations in 2020 but never officially adopted by Beirut. Israel retains full rights over the Karish gas field, which will come on stream shortly, once the testing procedure is completed.

Qana-Sidon

When it comes to the Qana prospect (also known as Sidon, or Sidon-South prospect) in Lebanon’s Block 9, Beirut wanted exclusive rights to exploit it (assuming a commercial discovery is made), even if a portion of the reservoir extends into the Israeli EEZ.

Lebanon did not want to engage in any joint development scheme that may be interpreted as a form of normalization with Israel.

Under the terms of the agreement, the entire prospect will be developed by the operator of Block 9 “exclusively for Lebanon”, but this is subject to the agreement between Israel and the operator over financial terms. Beirut had to concede to an arrangement that ensures Israel would get a compensation for its rights in the deposit.

To avoid any accusation of normalization, the text specifies that Israel “will be remunerated by the Block 9 Operator” without involving Lebanon in these arrangements and without affecting Lebanon’s agreement with the company nor its share of profits. The delicate but politically necessary arrangement glosses over the fact that any remuneration that the company will pay to Israel would affect the project’s overall profits and, therefore, Lebanon’s share of these profits.

Subject to the consent of both countries, the agreement also makes it possible for the operator to drill south of the maritime boundary line as Qana-Sidon is thought to extend – at least partially – into Israel’s Block 72. The block was put on offer as part of Israel’s third licensing round in 2020 and received two bids: one submitted by Noble Energy (now Chevron) and its partner Delek (now NewMed Energy), and another one submitted by Energean. But an antitrust dispute has held up the award and the issue is still being examined by the Supreme Court. Going forward, the block might be put on offer again to give Block 9’s operator a chance to obtain drilling rights or its boundaries will have to be reconsidered.

Other cross-border deposits

If other cross-border deposits are identified in the future, Lebanon and Israel can request the US to facilitate between them in order to reach an agreement on the allocation of rights before exploiting the field.

The two countries, and companies operating on either side of the boundary, are expected to share data on cross-border deposits with the US which will share it with the other party in a timely manner after receipt.

Block 9

Block 9’s operator – currently TotalEnergies – has a central and critical role in the arrangement designed by the US mediator. Hochstein’s master stroke was to get the French company on board.

Total had so far refrained from drilling in the block, including outside the disputed zone, due to an unfavorable risk-reward ratio. The French major was never enthusiastic about the Qana-Sidon prospect with its modest potential estimated at about 1.7 Tcf of natural gas. If a commercial discovery is made, it might be too small to justify development on its own, unless a tie-back to existing infrastructure is possible.

But Total appears to be committed to the project now. The company has held talks with Israeli officials about the potential distribution of profits from Qana-Sidon and sent a high-level delegation to Beirut to meet with PM Najib Mikati and officials from the Ministry of Energy on October 11, on the day the breakthrough in border talks was announced. Total assured its interlocutors it would be ready to launch preparations for drilling in Block 9 as soon as the maritime border deal is concluded.

The block is currently operated by France’s TotalEnergies (40%), as part of a consortium comprising Italy’s ENI (40%), with the remaining stake now going to the Lebanese State (20%) following Novatek’s decision to pull out. In a communication with the Energy Ministry, QatarEnergy has expressed interest to acquire Lebanon’s stake in the consortium in addition to five percentage points from Total’s and ENI’s stakes for a total of 30% interest in the Block.

Next steps

President Aoun announced Lebanon’s formal approval of the agreement on October 14. Opposition MPs have tried – and so far failed – to impose a parliamentary debate and vote on the deal.

The approval process is more complex in Israel. The government gave its ok on October 12 and referred the deal to the Knesset. Lawmakers will have 14 days to discuss, but not vote on, the text, before the government gives its final approval by the end of this month.

The deal will enter into force on the day in which the US issues a notice confirming that both Lebanon and Israel have sent a formal written response to Washington agreeing to the terms of the agreement.

Both countries will then simultaneously submit the list of geographical coordinates of the agreed maritime boundary to the Secretary General of the United Nations.

***

The deal is a remarkable diplomatic achievement and removes a significant point of friction between Lebanon and Israel, but it does not signal a change in the status of their relations. All throughout the mediation process, extra care was put into avoiding any semblance of normalization at the request of Lebanon. For its part, Israel will receive additional guarantees from the US, including a written commitment to its security and economic rights.

Yet, the deal establishes a “permanent maritime boundary” between Lebanon and Israel, and an “equitable resolution” of their maritime border dispute. The choice of words is in itself unusual between the two countries.

Pursuing exploration along the border will lock them into an endless cycle of coordination (granted via a third party), starting with drilling at Qana-Sidon and the development of the field if a commercial discovery is made, to the need to manage the exploitation of other potential cross-border deposits in the future. There will also be multiple instances of obstruction. These are after all complex situations that are not easy to handle even between friendly nations. They are rendered more challenging by the nature of relations between Lebanon and Israel. If not managed, they are likely to turn into new points of friction between the two countries.

For now, both countries will get the chance to test the impact of reduced tensions at the border on the attractiveness of their sector: Lebanon’s second offshore licensing round is due to close on December 15 – provided there are no delays -, and Israel is expected to launch its fourth licensing round later this year.

Finally, the deal adds a new mutually recognized maritime border in East Med. Another one may follow in its wake: the maritime border between Lebanon and Cyprus, agreed in 2007, but whose ratification was held up in Lebanon due to the border dispute with Israel.

$192 million to Aphrodite

The partners in the Chevron-operated Aphrodite gas field offshore Cyprus approved a budget of $130 million to drill the A-3 appraisal well in the first half of 2023, and another $62 million for a pre-front-end engineering and design (pre-FEED) study. The appraisal well, which will serve as a production well at a later stage, will be drilled by the Stena Forth drillship.

Chevron and its partners are examining various options to develop Aphrodite, including tie-back to existing facilities in Egypt or combining its development to the development plans of nearby assets (i.e. the Leviathan gas field in Israel’s EEZ).

According to recent comments by NewMed’s Chief Executive Yossi Abu, one of Chevron’s partners in Aphrodite, the focus now is on using existing infrastructure in Egypt, including underused platforms and pipeline systems, to save substantial capital expenditure. During the presentation of NewMed’s Q2 financial results in August, Abu revealed that there is a “commercial dialogue with the infrastructure owners” to determine if this option is technically and financially possible. The Aphrodite partners are expected to submit a revamped development plan to Cypriot authorities by the end of this year.

Noble Energy discovered Aphrodite in 2011. Preliminary estimates indicated that the reservoir may hold 5 to 8 tcf of natural gas. But an appraisal well drilled in 2013 revised these estimates down to about 4 tcf and complicated the prospects of developing the field.

Another challenge is that a small portion of the reservoir extends into the Yishai license in the Israeli EEZ. Despite years of negotiations, Cyprus and Israel have yet to conclude a unitization agreement and companies on both sides of the border have so far been unable to reach a deal on profit distribution. Israel and Cyprus maintain that they have made “significant” headway in resolving the dispute. Following a meeting between the Israeli and Cypriot energy ministers in Nicosia on September 19, the two countries pledged to “conclude a fair and swift resolution of the Aphrodite-Ishai issue”.

Energean strikes gas at Hermes

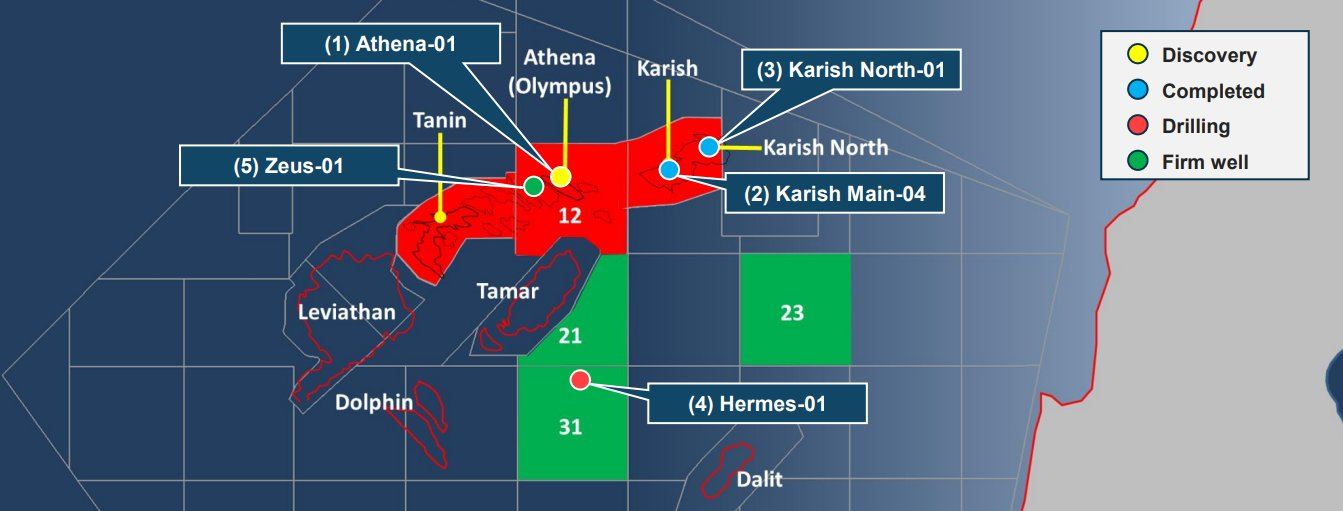

Energean announced a commercial gas discovery at its Hermes exploration well in block 31, offshore Israel, on October 6.

According to preliminary estimates, Hermes is believed to hold between 7 and 15 bcm of recoverable volumes, a more modest result compared to the 13-40 bcm initially targeted. Energean believes the discovery helps de-risk the nearby Poseidon and Orpheus structures which the company may target in the future as it seeks to assess Block 31’s potential.

The Stena IceMax drillship has since moved to block 12 to drill the Zeus structure in what Energean calls the Olympus Area which includes undrilled prospects in Block 12 and the adjacent Tanin Lease. Last May, the Greek company announced a first gas discovery in the Olympus Area with the drilling of an exploration well at Athena, which is estimated to hold around 8 bcm of natural gas.

Energean is considering various monetization options for its new gas finds in the Olympus Area. It had previously indicated that they could be tied to the Energean Power FPSO or be part of a wider Olympus Area development. The Greek company is pursuing various options for commercialization, including further sales to the domestic market or exporting the gas to regional and European markets by pipeline or in LNG form via Cyprus and/or Egypt.

In its press release, Energean also confirmed that it exercised its option to drill a sixth well with Stena Drilling Limited as part of its growth drilling program in Israel. This well is expected to target the Hercules prospect in block 23.

A greener EMGF looks to closer cooperation with Europe

The East Mediterranean Gas Forum (EMGF) held a conference on energy transition in Nicosia on October 14. Member States want to improve their green credentials as they seek to boost their exports to respond to Europe’s energy crisis and attract new investments in their upstream sectors.

The Forum recently commissioned a study on the decarbonization of the natural gas value chain in the Eastern Mediterranean. Highlights from the study were presented at the conference. The final results will be presented at the upcoming UN Climate Change Conference COP27, which will be held next month in Sharm el-Sheikh, Egypt.

Egypt’s Petroleum Minister Tarek el Molla insisted on the importance of securing funding from international and European financial institutions to speed up the development of natural gas resources in the region and boost exports. Pointing in particular to the European Bank for Reconstruction and Development (EBRD) and the European Investment Bank (EIB) both of which are scrapping investments in oil and gas projects, the Minister said: “When I talk about funds, I am not talking about commercial funds… They need to be somehow concessionary funds with easy access and relaxed terms”.

Such financing packages could run alongside ‘important efforts’ to build a green corridor between the East Mediterranean and Europe focused on either hydrogen or renewable electricity. “This all should be carried together in parallel,” El Molla said.

NewMed to enter Egypt via Capricorn acquisition

London-listed Capricorn Energy, formerly known as Cairn Energy, ditched plans for a merger with UK-based Tullow Oil in favor of a combination with Israel’s NewMed Energy. The new entity – to be led by NewMed’s CEO Yossi Abu – will trade under the name NewMed Energy and will reportedly be one of the largest upstream energy independents listed in London.

A cash special dividend of $620 million is proposed to be paid to Capricorn shareholders prior to the completion of the combination, equivalent to £1.72 per share. Capricorn shareholders will hold approximately 10.3% of the combined entity, with the remaining 89.7% going to NewMed shareholders.

The transaction creates a gas-focused company with producing assets in Israel and Egypt and a diversified exploration portfolio across Cyprus, Egypt, Israel, Mauritania, Mexico, Suriname and the UK.

If finalized, the deal between the two independents will mark the entrance of Israel’s NewMed into Egypt’s upstream sector. Capricorn made its entry into Egypt’s oil and gas sector in 2021 by acquiring Shell’s upstream assets in Egypt’s Western Desert along with partner Cheiron. The acquired portfolio included 13 concessions as well as Shell’s stake in Badr El-Din Petroleum Company (Bapetco), a 50:50 joint venture with the Egyptian General Petroleum Corporation (EGPC).

Egypt: Chevron spuds exploration well in Nargis

As announced by Chevron’s Chief Executive Mike Wirth during his visit to Egypt in June, the US major has now started drilling its first exploration well in Egypt, in the Nargis offshore block where it holds an operating interest as part of a consortium with Tharwa Petroleum. The Stena Forth drillship is operating about 70 km west of the 1-Tcf Gaza Marine gas field, off the Gaza strip.

In Egypt, the US major holds operating stakes in four offshore blocks: North Sidi Barrani and North El Dabaa in Egypt’s Western Mediterranean, Nargis off the Sinai Peninsula and Block 1 in the Red Sea.

Following its acquisition of Noble Energy in 2020, Chevron also inherited non-operating stakes in two other West Med acreages: North Marina and North Cleopatra.

Chevron is upbeat about its prospects in the Eastern Mediterranean where it sees “opportunities for expansion”. It has recently signed a memorandum of understanding with the Egyptian Natural Gas Holding Company (EGAS) to evaluate options to transport, import, liquefy, and export natural gas from the Eastern Mediterranean.

This includes examining the needed infrastructure to facilitate the transport of East Med gas to Egypt and carrying out the necessary studies to produce low-carbon LNG.

In Cyprus, the US major is expected to submit a development plan for the Aphrodite gas field by the end of 2022, before drilling an appraisal well later in 2023. And in Israel, the company is preparing to unveil the concept for the expansion of Leviathan’s output potentially by the end of this year. Both projects may involve exports to world markets via Egypt’s LNG terminals.